how does capital gains tax work in florida

As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in florida. Does florida have capital gains tax on real estate.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Income over 445850501600 married.

. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. There are two different types of capital gains taxes. Capital Gains Tax.

Above that income level the rate jumps to 20 percent. 250000 of capital gains on real estate if. Browse Get Results Instantly.

The federal government however imposes an estate tax that applies to residents of all states. Rule 12C-1013 Florida Administrative Code. The capital gains tax is calculated on the profit made from the real estate sale minus expenses and the applicable capital gains tax will depend on who holds the title.

Also nonresidents of FL who sell property located in FL state do not owe a capital gains tax to the state of FL on that sale. November 19 2021 by Brian A. The capital gains tax is calculated on the profit made from the sale of real estate.

Section 22013 Florida Statutes. Short-term capital gains are taxed as ordinary income at rates up to 37 percent. Ad Search For Info About Florida capital gains tax.

Any money earned from investments will be subject to the federal. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

Capital gains are generally included in taxable income but in most cases are taxed at a lower rate. An accountant will guide you as to what qualifies as expenses. This amount increases to 500000 if youre married.

When it comes to calculating the amount you have to pay to tax on these gains it. At 22 your capital gains tax on this real estate sale would be 3300. Capital gains tax is effectively tax you pay on the profit youve made on your propertys appreciation since you bought it.

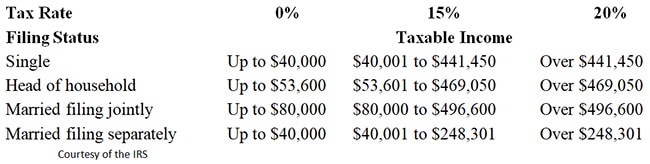

Florida Capital Gains Taxes. Income over 40400 single80800 married. The long-term capital gains tax rate is typically zero 15 or 20 percent depending on your tax bracket.

The second tax to be aware of is the capital gains tax. For example the main city gains rate for US. Individuals and families must pay the following capital gains taxes.

You would report cryptocurrencies on Schedule D the same federal tax form you would use to report capital gains such as the profit you made from selling a piece of real estate. Capital Gains Tax Rate In Florida Capital Gains Tax Rate 2022 It is generally accepted that capital gains are earnings that are earned through the sale of an asset such as stocks or real estate or a company and are taxable income. The profit is revenue sale price less purchase price minus expenses.

Ncome up to 40400 single80800 married. The state of FL has no income tax at all -- ordinary or capital gains. Take advantage of primary residence exclusion.

In Florida theres no condition tax as theres in other US states. Should you make money using investments youll be susceptible to the government capital gains tax. Long-term gains are taxed at lower rates up to 20 percent.

Florida doesnt have condition tax meaning theres also no capital gains tax in the condition level. If you are a resident of FL and you have gains on the sale of a capital asset you would not owe any taxes to the state of FL on the gain from that sale. Calculating Capital Gains On Your Florida Home Sale In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis.

For example if you buy 50 shares of stock worth 100 each then sell all 50 shares when theyre worth 150 youd pay capital gains taxes on the 50 difference 2500 in total. As mentioned Florida does not have a separate inheritance death tax. However theyll pay 15 percent on capital gains if their income is 40401 to 445850.

You can maximize this advantage by frequently moving homes. SmartAnswersOnline Can Help You Find Multiples Results Within Seconds. Beside this How much is capital gains in 2021.

Your primary residence can help you to reduce the capital gains tax that you will be subject to. It is important to keep accurate. How much is capital gains tax in Florida.

Your income and filing status make your capital gains tax rate on real estate 15. This tax is called Capital Gains tax. The IRS typically allows you to exclude up to.

Edited By Savannah Hanson. Obtaining the amount requires you to make adjustments including acquisition and improvements costs. Capital gains tax is a tax you pay on the profit you make when you sell an asset.

The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple. If the asset is owned for greater than one year capital gains tax rates are applied to the amount of gain zero for gains that would otherwise be taxed at the 10 or 15 rates 15 for gains that would be taxed at the 25 28 33 or 35 and 20 for gains that would be taxed at the 396 rate. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term capital gains.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. The federal estate tax only applies if the value of the entire estate exceeds 117 million 2021 and the tax thats incurred is paid out of the estatetrust rather than by. Written By Terry Turner.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. Therefore you would owe 2250. The United States Government taxes the profits property owners earn from the sale of their properties.

The capital gains tax is based on that profit. Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. Florida does not assess a state income tax and as such does not assess a state capital gains tax.

But it also presents tax challenges. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate. Short-term capital gains tax.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. And Section 5 Florida Constitution. It depends on your tax filing status and your home sale price but you may be eligible for an exclusion.

What is capital gains tax. Its also important to remember that if you paid employees using cryptocurrency you need to report that to the IRS on a W-2. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and.

How Much Tax Will I Pay If I Flip A House New Silver

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Estimated Tax Penalties For Home Resales

Capital Gains Tax Calculator 2022 Casaplorer

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax What Is It When Do You Pay It

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How Capital Gains On Real Estate Investment Property Works

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Florida Real Estate Taxes What You Need To Know

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How High Are Capital Gains Taxes In Your State Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe