child tax credit december 2021 payment

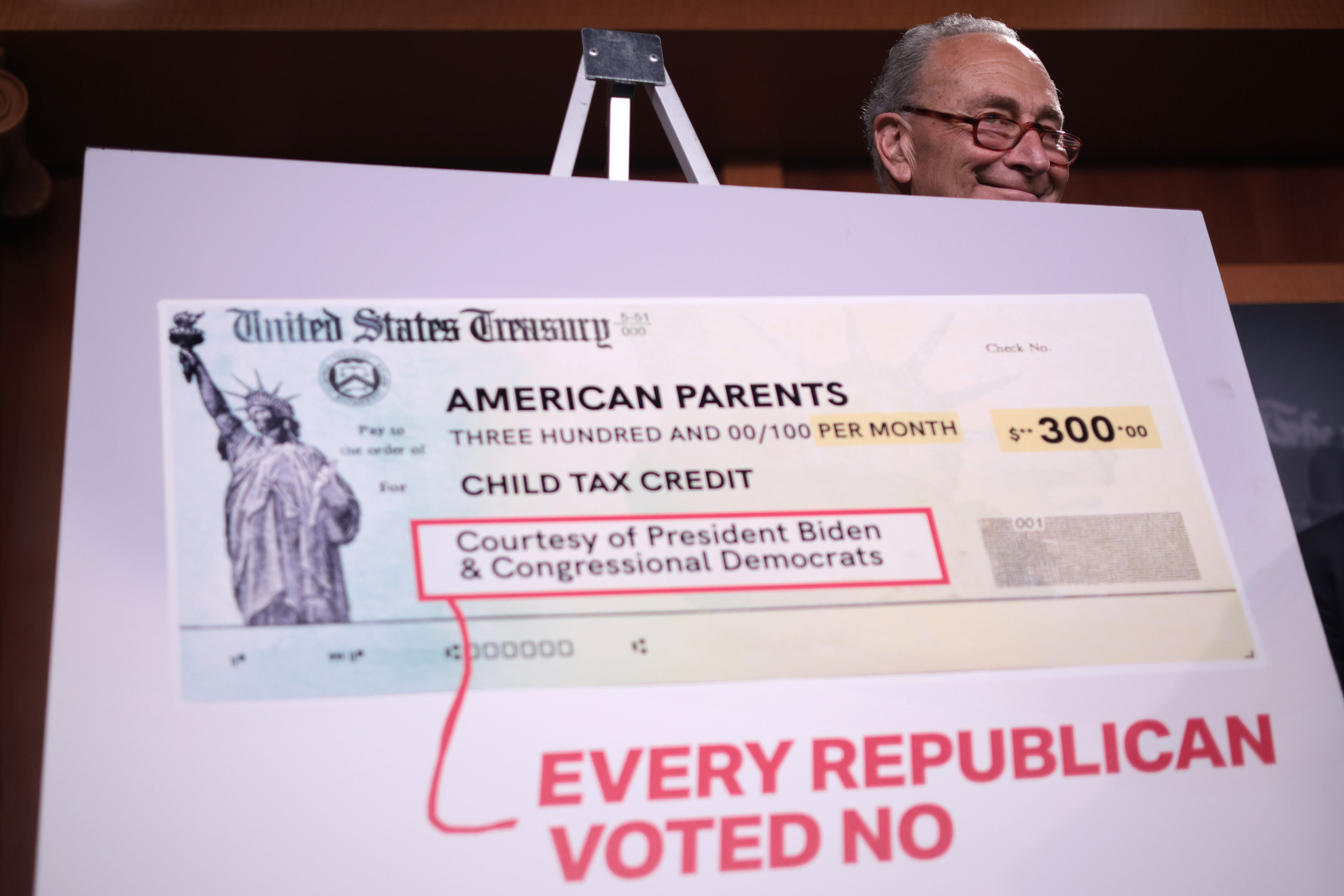

Claim the full Child Tax Credit on the 2021 tax return. Due to the American Rescue Plan enacted March 2021 the 2021 child tax credit was raised from 2000 per child.

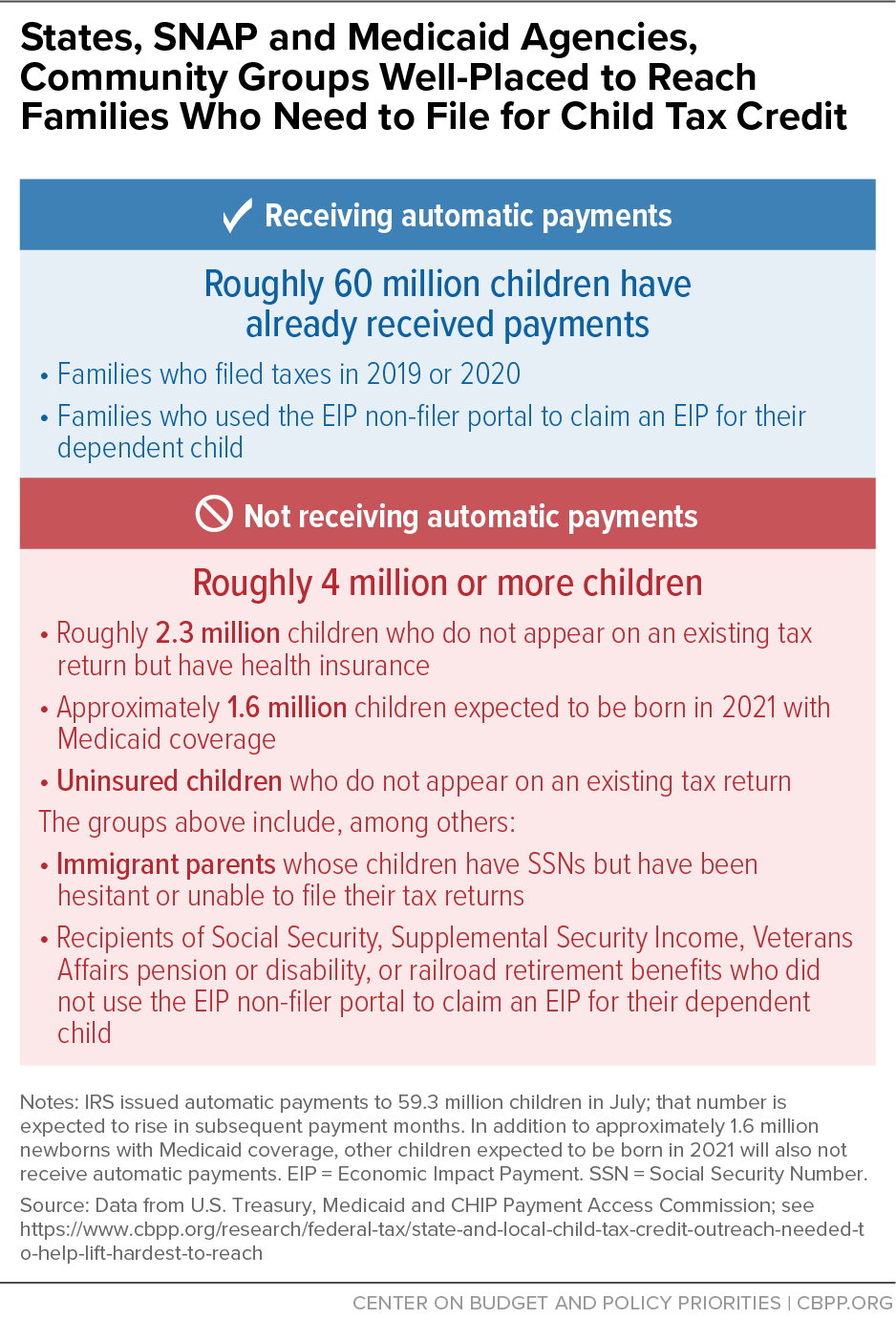

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

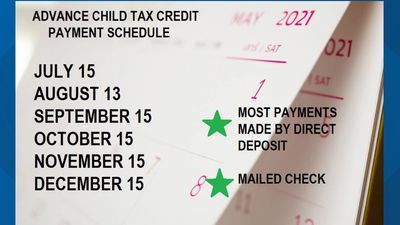

Schedule of 2021 Monthly Child Tax Credit Payments.

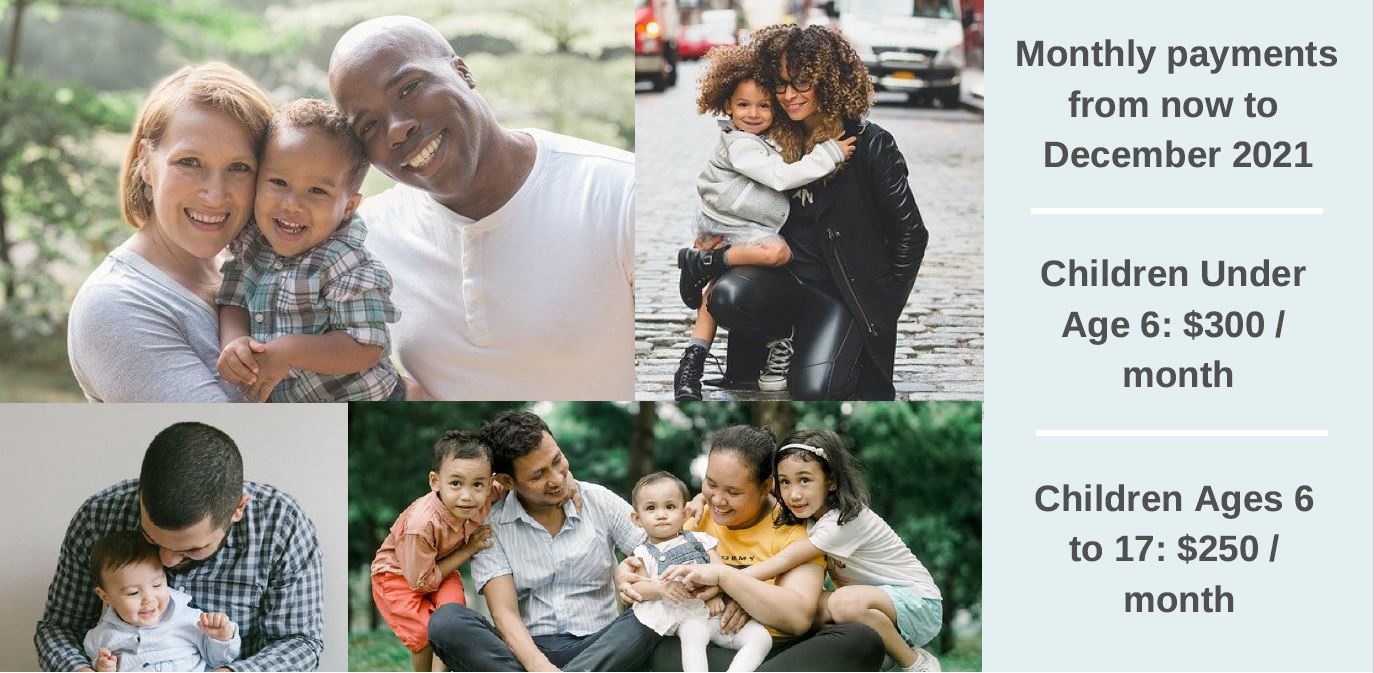

. So each month through December parents of a younger child are receiving 300 and. Previously the credit allowed parents to claim up to 2000 per eligible child under age 17. Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families.

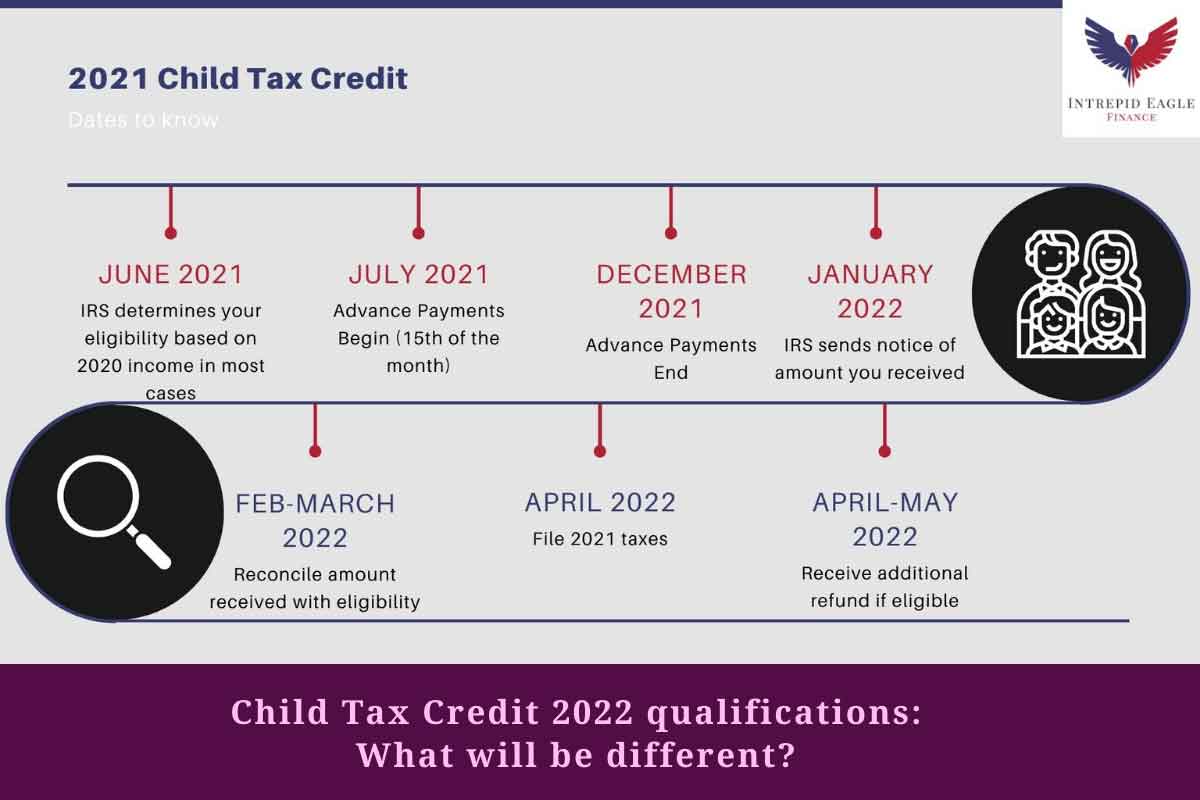

It was just temporarily expanded for 2021. During 2021 the vast majority of eligible families received half of their Child Tax Credit through. December 13 2021 Taxes.

2021 Child Tax Credit Reminder. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Subscribe to Kiplingers Personal Finance.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Eligible families have received. Previously only children 16 and younger qualified.

Find out if they are eligible to receive the Child Tax Credit. The IRS pre-paid half the total credit amount in monthly payments from. This means that the total advance payment amount will be made in one December payment.

With all monthly child tax credit payments disbursed in 2021 more money is on the table for this year. Understand how the 2021 Child Tax Credit works. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Well tell you when this payment will arrive and how to unenroll. The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The Child Tax Credit isnt a new benefit. Only one child tax credit payment is left this year.

Advance payments went to the families of over 61 million children from July to December 2021. Taxpayer income requirements to claim the 2022 child tax credit. The credit amounts will increase for many.

Eligible families who did not. Understand that the credit does not. All payment dates.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. October 5 2022 Havent received your payment. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The credits scope has been expanded. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in.

Wait 10 working days from the payment date to contact us. Be a smarter better informed investor. Get the Child Tax Credit.

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Bolen Vineyards On Twitter Anyone Know How I Can Opt Out Of These Stupid Advance Child Tax Credit Payments Tired Of The Federalreserve Printing And Putting More In Circulation Https T Co Jfvqbslcuc

Will Monthly Child Tax Credit Payments Be Extended Into 2022 Fast Forward Accounting Solutions

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

Fact Sheet Advance Child Tax Credit

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

What To Know About The New Monthly Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

Families Will Soon Receive Their December Advance Child Tax Credit Payment

Center For Siouxland It S Almost Time To File Your Taxes The Irs Is Sending Letters To Those Who Received Advance Child Tax Credit Payments And Or The 3rd Economic Impact Payment Aka

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

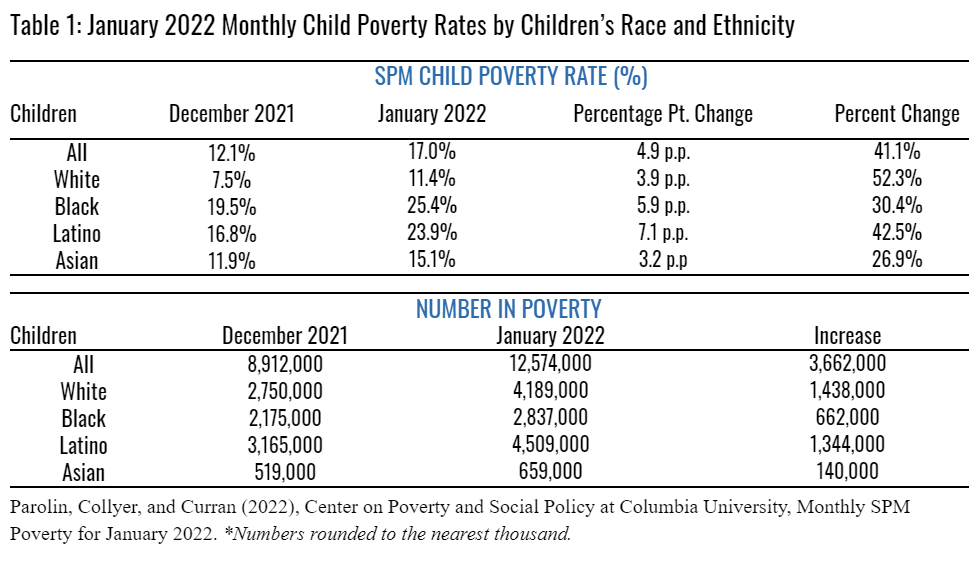

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit Payments Are Keeping Savings Balances Stable About Saverlife

About The 2021 Expanded Child Tax Credit Payment Program

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The